Wokelo AI – Quick briefing (15 min)

Consumer – Food and Beverages – Alternative Proteins

Wokelo – Sector trends, Deal highlights (Private Equity, Venture Capital, M&A)

Alt Meat or Alt Reality? The Truth Behind Alternative Proteins’ Billion-Dollar Promise

Is meat alternatives the next big thing in food tech—or a market bubble soon to pop? Investors are digging in deep to find out.

In the last few years, alternative proteins have transitioned from niche curiosity to strategic imperative, inspiring hope for a more sustainable, resilient, and equitable future for food production and consumption.

The sheer breadth of innovation—from plant-based “meats” that taste nearly indistinguishable from their animal equivalents, to fermentation-derived products that yield proteins without the typical farmland footprint, and even cell-based prototypes that grow real meat in a lab—points to a paradigm shift.

Navigating Consumer Acceptance: Taste, Texture, and Trust

No matter how compelling the carbon numbers and cost savings, no consumer is going to compromise on taste and texture. Key lessons from the frontlines:

⦁ Taste: The Holy Grail. From plant-based burgers that sizzle like beef to cultivated chicken that replicates the fibrousness of conventional poultry, taste improvements are leaping forward. For instance, Quorn’s mycoprotein overcame early dryness issues, and the expiration of certain patents has allowed new entrants to refine the process further.

⦁ Texture: The Mouthfeel Factor. Creating that characteristic meaty bite requires specialized technology. High-moisture extrusion, shear-cell processing, or 3D bioprinting are all methods aiming to nail the texture that consumers prize.

⦁ Sensory “Add-Ons”. Fermentation-based flavors, advanced heme proteins (like Motif FoodWorks’ HEMAMI™), or cultured fats (like Hoxton Farms) are driving the next wave of sensory authenticity.

⦁ Overcoming Skepticism. Many people are wary of “lab-grown” or “engineered” foods. Clear, transparent labeling and trustworthy regulation are imperative. Education campaigns—from restaurants to social media—will be critical. Beyond Meat and Impossible Foods had initial success by positioning themselves as “real food” from plants and focusing on hyper-realistic advertising.

Ultimately, companies that triumph in taste and tell a transparent story on product safety and benefits will capture mainstream consumer loyalty.

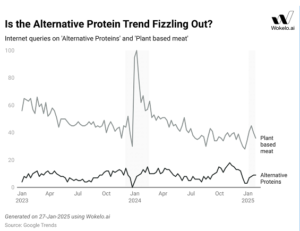

It’s been a bumpy ride

Despite popularity among the curious and the health conscious, consumer demand has been fickle – driven in waves by trends like Veganuary, or introduction in menus of popular fast food chains like Burger King and Wendy’s. Concerns around price, degree of processing, and dissatisfaction with taste and texture have caused large brands like Beyond Meat to face financial struggles.

High cost of R&D and operating costs have also created troubles for smaller companies in the space for whom it’s been near impossible to replicate the operational scale and economies of the meat and dairy industries, or invest in expensive intellectual property.

Even for large companies, mainstream adoption is yet to reach level and pace to keep up with the high cost of production and operation – a milestone that may still be a few years away.

Pivotal Role in Climate Action—Rivaling Aviation Decarbonization

One of the most striking revelations in recent literature is the climate impact potential of alternative proteins. Analysis from top consulting firms like BCG underscores that shifting to alternative proteins could single-handedly remove up to 0.85 gigatons of CO2 equivalent by 2030, rivaling the cuts we’d see through aggressive decarbonization of other large emitters—some estimates even suggest the scale can be bigger than decarbonizing 95% of the aviation industry over the coming decades.

Why does this matter? Livestock farming is a major driver of methane emissions, deforestation, and water consumption. Alternative proteins offer a significantly lower greenhouse gas footprint and can help address one of the biggest environmental challenges: reducing methane—a potent greenhouse gas with a warming potential far exceeding CO2 in the short term.

For governments prioritizing net-zero targets, investing in alt proteins is often the most cost-effective climate solution. Indeed, IoCE (Impact on Capital Employed) analyses show that capital put into alternative proteins yields a climate benefit three to four times higher than the same capital put into decarbonizing cars or maritime shipping.

Driving Down Costs—Where We Stand and the Road Ahead

Despite remarkable progress, one fundamental barrier remains: cost. A steak grown in a bioreactor or a fermentation vat still costs multiple times more to produce than a commodity beef steak. Even the more established plant-based products can run 10–20% higher at retail, especially in developing markets.

However, the path to cost parity or cost advantage is becoming clearer:

- Economies of Scale: Similar to solar or battery industries, alt protein manufacturing costs decline sharply as production volume grows. Early movers that build capacity now stand to unlock the largest cost reductions.

- Precision Fermentation: By harnessing microbial precision fermentation, companies can produce proteins (and even fats) at scale, leveraging cheaper feedstocks like sugar and eventually biomass or agricultural byproducts. This jump can reduce reliance on expensive growth media historically used for cell-based and fermentation-derived proteins.

- Optimized Supply Chains: Companies such as Solaris Biotech and Dyadic International are building advanced fermentation platforms and refined microbial lines, drastically reducing production overheads.

- Hybrid Products: We’re seeing blended solutions—where a cultivated meat core is combined with plant-based binders or fats. These “hybrid” products can deliver the sensory experience of conventional meat while lowering cost by reducing the proportion of expensive cultivated cells.

Result: Within the next five to seven years, we can expect leading alt protein products to match or beat conventional meat on price. At scale, many foresee radical cost advantages for alt proteins, especially in a world where water and land resources grow scarcer, and carbon pricing or methane regulations come into effect.

Regulations: A Global Patchwork Slowly Converging

As with any revolution in food, regulation can be the biggest accelerant—or the biggest drag. Consider the patchwork:

- Singapore was the first to approve the commercial sale of cultivated meat.

- Israel has offered regulatory fast-tracks for cultivated dairy and meat.

- In the U.S., the FDA recently restructured certain offices to better handle novel foods. Approvals for cultivated chicken from GOOD Meat and UPSIDE Foods signal the agency’s evolving stance.

- Europe remains conservative, with the European Food Safety Authority (EFSA) requiring extensive trials. Conversely, some countries (like Italy) are toying with partial bans.

Implication: Harmonizing these rules is a prerequisite for truly global growth. The sector needs consistent definitions, safety standards, and labeling guidelines. Progress is happening—trade associations and alliances such as the Precision Fermentation Alliance and the Fungi Protein Association are helping unify industry voices for better regulation. Over time, early approvals in certain markets can fuel a virtuous cycle of acceptance across others, provided the safety track record remains solid.

Funding and Strategic Deals: Consolidation and Collaboration on the Rise

Against the backdrop of economic headwinds and rising interest rates, the alt protein sector has still attracted billions in venture and corporate funding. Some noteworthy points:

- Big Bets in Cultivated Meat: UPSIDE Foods, Believer Meats, and GOOD Meat collectively pulled in over USD 1 billion across 2021-2022. There’s also been notable expansions from pure-play startups to hybrid approaches that integrate plant or fermentation bases.

- Major Deals: From Starco Brands’ acquisition of Soylent to Nourish You acquiring One Good in India’s largest plant-based dairy M&A, these deals hint at consolidation and vertical integration. We’ll see more synergy-based acquisitions as legacy players aim to catch up with cutting-edge alt protein startups.

- Infrastructure Investments: Companies like Meati Foods built a “Mega Ranch” capable of producing tens of millions of pounds of mushroom-based protein. Similarly, Solaris Biotech invests in large-scale fermentation capacity for cultivated meats or specialized ingredients.

| Organization | Overview | Summary |

|---|---|---|

| Impossible Foods | Plant-based meat alternatives that offer environmentally friendly options for regular meat. | • Impossible Foods, a major player in the plant-based meat industry, has successfully raised nearly $2 billion in funding. The company is recognized for its plant-based meat products and has experienced considerable growth over years. |

| Meati Foods | Mushroom-based protein alternatives offering a sustainable option for meat. | • Meati Foods has aggressively expanded its market presence by raising an impressive $100 million in its latest C-1 funding round, on top of $200 million in Series C funding raised earlier. With its ‘Mega Ranch’ facility, Meati Foods has significantly scaled its production, capable of delivering tens of millions of pounds of protein annually. |

| Heura Foods | Plant-based vegan food products that promote sustainability and health. | • Heura Foods secured €40 million in a Series B funding round, contributing to the company’s expansion and aiming for profitability. The company focuses on providing additive-free vegan products with strong sensory and nutritional values, and has expanded its reach across over 22,000 locations in more than 20 countries. |

| SCiFi Foods | Previously specialized in innovative alternative protein solutions. | • SCiFi Foods closed operations after raising close to $40 million, reflecting the financial difficulties and funding challenges faced by companies within the alternative protein sector. |

| Novameat | Advanced alternative meat products utilizing proprietary 3D texture-building technologies. | • Novameat, based in Barcelona, raised $19.2 million in a Series A funding round, which will be directed towards expanding production capacity for their alternative meat products that feature a unique 3D texture-building technology. |

| NovoNutrients | Microbial fermentation-derived proteins from CO2 for diverse nutritional applications. | • NovoNutrients raised $18 million in Series A funding to advance their innovative approach to producing proteins from carbon dioxide and hydrogen through microbial fermentation. They focus on applications in livestock, fish feed, human nutrition, and pet food. |

| Formo | Animal-free cheese products made using microbial fermentation, reducing environmental impact. | • Formo successfully raised $61 million in Series B funding while launching animal-free cheeses via microbial fermentation in stores across Germany and Austria. |

| New School Foods | Plant-based seafood alternatives featuring realistic fish-like textures. | • New School Foods has successfully raised $12 million for the development of its plant-based seafood alternatives that utilize cold-based processing technology to replicate fish muscle fibers and structures. |

| Pacifico Biolabs | Seafood alternatives manufactured through biomass fermentation to emulate traditional seafood textures and flavors. | • Pacifico Biolabs secured $3.3 million in pre-seed funding to further its mission of developing seafood analogues using biomass fermentation technologies. |

To truly appreciate the potential of alternative proteins, one has to cut through the noise surrounding vastly different market forecasts. Depending on the source and methodology, valuations for today’s alternative proteins market vary:

- BCG projects that, with supportive policies and technology, alternative proteins might secure 11% to 22% of the global protein market by 2035.

- EY projects the sector will grow from USD 14.1 billion in 2021 to USD 17.4 billion by 2027 (CAGR of 3.7%).

- IndustryArc predicts the global Alternative Protein Market will grow from $15 billion in 2023 to $30 billion by 2030 (CAGR of 10.4%)

| Acquirer/Buyer | Target | Deal Rationale |

|---|---|---|

| Starco Brands | Soylent | • Soylent was acquired by Starco Brands to expand its distribution and marketing efforts. |

| • Soylent will continue as a separate business unit, led by its CEO Demir Vangelov, under the broader umbrella of Starco Brands. | ||

| • The acquisition provides Soylent access to public capital and marketing resources. | ||

| • The deal involved a transfer of shares, where Soylent’s shareholders, including the CEO, became significant stakeholders in Starco Brands. | ||

| Nourish You | One Good | • Nourish You completed the acquisition of One Good, positioning it as the largest M&A deal in India’s alternative dairy sector. |

| • The acquisition was done via a share swap, allowing Nourish You to transition from a superfood brand to a plant-based brand. | ||

| • One Good is recognized for its dairy-free products such as cashew-oat-millet milk and vegan ghee alternatives. | ||

| • Post-acquisition, all senior management from One Good retained their roles. | ||

| Shiok Meats | Gaia Foods | • Shiok Meats, a pioneer in cell-based seafood, acquired Gaia Foods to diversify into cultured red meats. |

| • The acquisition brings on Gaia Food’s technical team to support Shiok Meats in the cell-based red meat development. | ||

| • This strategic move follows Shiok Meats’ recent $10 million funding round and continues its growth plan. | ||

| • Shiok Meats is expanding its product range and market presence through this acquisition. |

The big takeaway from such wide-ranging estimates is that the trajectory—despite the fluctuations in absolute numbers—points uniformly upward.

Trend: As manufacturing scales and new product lines appear, co-manufacturing deals, joint ventures, and supply chain alliances will intensify. The largest conventional protein companies—from JBS to Tyson—are also moving in, ensuring alternative protein is an “and” rather than an “or” in their product portfolios.

Beyond Meat vs. Alternative Proteins 2.0

“Beyond Meat” here symbolizes the first wave of commercially popular plant-based burgers, sausages, and chicken nuggets. But the conversation has since expanded to include a second wave:

- Cell-Based Seafood. Startups like Pacifico Biolabs or Wildtype are generating seafood that replicates the delicate texture of fish or shrimp. This is crucial for mitigating overfishing and preserving marine biodiversity.

- Precision-Fermented Dairy. Perfect Day and Formo produce key milk proteins in fermentation tanks. They solve lactose intolerance concerns, cut the ecological footprint, and allow for “real dairy” products without cows.

- Cultivated Fat. The flavor and mouthfeel of real meat are strongly tied to its fat composition. Companies like Cultimate Foods or Hoxton Farms are cracking the code of cultivated fat to combine with plant-based protein bases.

- Mycelium & Fungal Solutions. By harnessing fungi’s speed of growth and nutritional qualities, companies (e.g., Mycorena, The Better Meat Co.) can produce protein with minimal land and water usage.

Result: The sector is no longer defined by “pea vs. soy.” Instead, there’s a mosaic of technologies that can cater to diverse consumer needs, from artisanal cheese lovers to sushi connoisseurs.

From Niche to Norm: Implications for Investors, Governments, and Society

For Investors: The next decade should see a flight to quality. Not all alt protein startups will survive—some have already shuttered (like SCiFi Foods). Yet robust success stories (Meati Foods, Impossible Foods) indicate that if you invest in the right product and technology with a credible path to scaling, returns can be substantial. Distressed valuations in 2023-2024 open a window for strategic investments.

For Governments and Policymakers: Funding alternative protein R&D, offering tax breaks or carbon credits, and developing consistent labeling laws can catalyze the industry. Food security in the face of climate upheaval remains a critical driver—solutions that free up land and water while ensuring nutritional adequacy are winning political support.

For Consumers: “Flexitarianism” is going mainstream. People might start their day with a plant-based egg, enjoy a cell-based burger for lunch, and top their pizza with precision-fermented cheese. As cost parity hits, taste improves, and the novelty fades, these alternatives will quietly become an integral part of daily diets.

Scenarios for the Future

- . Alternative Proteins Reach Cost Parity Within a Decade

Ongoing R&D and capital infusion bring down production costs. By 2030, alt protein staples at grocery stores match or undercut their conventional counterparts. Mainstream adoption soars, especially in regions prioritizing climate resilience and sustainability.

- Technological Leapfrogs in Emerging Markets

As EVs leapfrogged outdated auto tech in certain emerging countries, alt proteins can skip resource-intensive livestock systems. With the right support, Africa, parts of Asia, and Latin America might accelerate alt protein adoption to ensure food security and bolster rural economies.

- .Consolidation and Convergence

Large meat producers buy out or partner with promising alt protein start-ups. The lines between “traditional meat” and “alternative proteins” blur, as companies adopt a portfolio strategy. Cultivated meat, insect proteins, and plant-based forms exist side by side on supermarket shelves.

- Pushback from Traditional Agricultural Interests

As alt proteins scale, some livestock sectors may resist, lobbying for labeling restrictions or regulatory roadblocks. Consumer fear-based campaigns around “unnatural” or “lab-grown” foods could generate short-term drag. Nonetheless, transparency, robust science, and consumer education can mitigate the friction.

Conclusion: Seizing the Opportunity for a Greener, Healthier Future

The transition to alternative proteins is a once-in-a-generation overhaul of our global food system. The data is unequivocal: alt proteins significantly cut greenhouse gas emissions, conserve land, and reduce water usage. They appeal to consumers seeking healthier, more ethical diets. Governments see a strategic solution for food security and climate goals, while entrepreneurs and established players alike find growth and innovation potential.

For businesses looking to enter or expand in this space, the recipe for success includes:

- Taste and Texture Innovations to capture mainstream appetites.

- Strategic Partnerships and Acquisitions that leverage scale and distribution.

- Proactive Regulatory Engagement to secure faster approvals and establish trust.

- Cost Reduction Roadmaps that aggressively target economies of scale.

In short, we are witnessing the early days of an industry that could be as transformative to agriculture and food as the EV revolution has been to transportation. The tipping point will come when alternative proteins no longer command a green premium but become the default, cost-effective protein choice. With scientific breakthroughs, supportive policy, and consistent capital, that day may arrive sooner than we think.